Our unique

approach

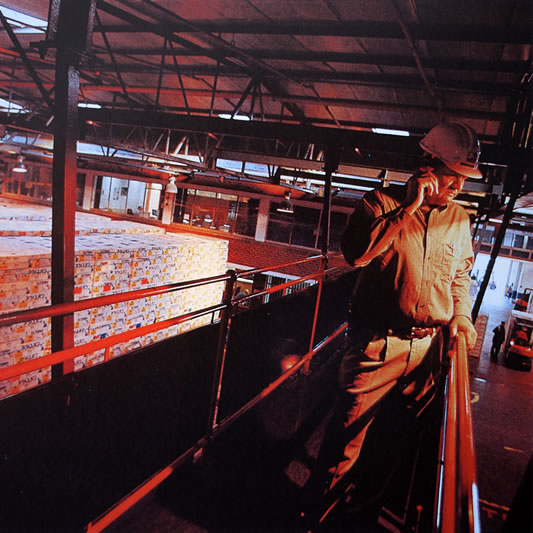

The Group combines the assets, growth record and professional skills of major public limited corporations, with the freedom, rapid response and entrepreneurial style of a private concern. This enables us to maintain the firm foundations we have established, to seek out fresh investment opportunities to grow our core businesses and to maximise financial returns.

Strategic intent

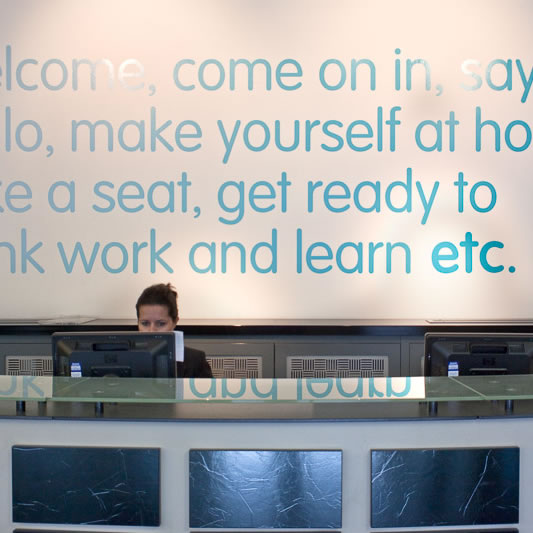

Our principal objective is to add significant value in everything we do for the benefit of our stakeholders – by which we mean our people, the companies that we invest in and our customers. We achieve this through a combination of strengths: focus on areas of expertise and innovation relating to our core businesses; leadership in the sectors and markets in which we participate; active investment supportive of, and close working with, management; and the creation of strategic partnerships with other commercial organisations who can benefit from our expertise.

Qualities and values

We run all our businesses to the highest professional standards, using similar corporate governance structures and financial disciplines associated with large public companies. We blend this with our own unique collegiate, consensual style of management – rigorously analytical yet encouraging innovation and rewarding entrepreneurial endeavour. Our core values are based on absolute personal and commercial integrity, hard work and loyalty to our employees, advisers, customers and partners.

Committed to the future

We are maintaining leadership in our core businesses, taking advantage of opportunities for further investment, and acquiring and investing in new businesses. All of this is facilitated by the freedom and flexibility of our private status. We are confident that the rapid response and professionalism of our execution will allow us to implement our ambitions.